Key Trends and the Growing Role of Wireless Spectrum

Megan Finch

As we approach 2025, technology continues to evolve at an unprecedented pace, driving advancements that are reshaping industries and everyday life. From artificial intelligence (AI) to broadband expansion, several key trends are set to dominate the tech landscape. At the heart of these developments lies the critical role of wireless spectrum, ensuring the seamless connectivity and speed needed to power these innovations. Here’s a look at what’s coming:

1. Sensors Driving AI Programs

Sensors are becoming more ubiquitous, serving as the eyes and ears of AI agents and programs. From smart home devices to industrial IoT applications, sensors collect real-time data that AI systems use to make decisions. Drones, in particular, are capturing vast amounts of data for applications like agriculture, disaster response, and infrastructure inspection, further highlighting the need for reliable connections. These programs rely on constant, reliable input to operate effectively, whether it’s monitoring equipment, tracking environmental changes, or enhancing user experiences. Wireless spectrum ensures these sensors and drones stay connected, transmitting data without delays or interruptions.

2. CBRS Spectrum Congestion

The Citizens Broadband Radio Service (CBRS) band has unlocked new possibilities for private networks and cutting-edge wireless applications. Yet, as adoption grows, CBRS congestion is emerging as a pressing challenge. To ensure seamless connectivity, securing a PAL to reserve part of the frequencies or exploring alternative licensed spectrum bands is crucial. As CBRS continues to develop, it’s thrilling to anticipate how these advancements will redefine connectivity solutions. Identifying the ideal spectrum for each application will remain essential to achieving consistent reliability and performance.

3. Broadband Expansion Across the U.S.

Efforts to reduce broadband deserts are accelerating, with infrastructure projects bringing high-speed internet to underserved areas. This expansion is bridging the digital divide, enabling more communities to access education, healthcare, and economic opportunities online. As broadband reaches more areas, additional infrastructure, such as wireless towers, will need to be built. This development also makes it easier for utilities to establish their own private networks, enhancing connectivity and operational efficiency. Wireless spectrum plays a vital role in extending connectivity to rural and hard-to-reach areas while supporting these growing infrastructure needs.

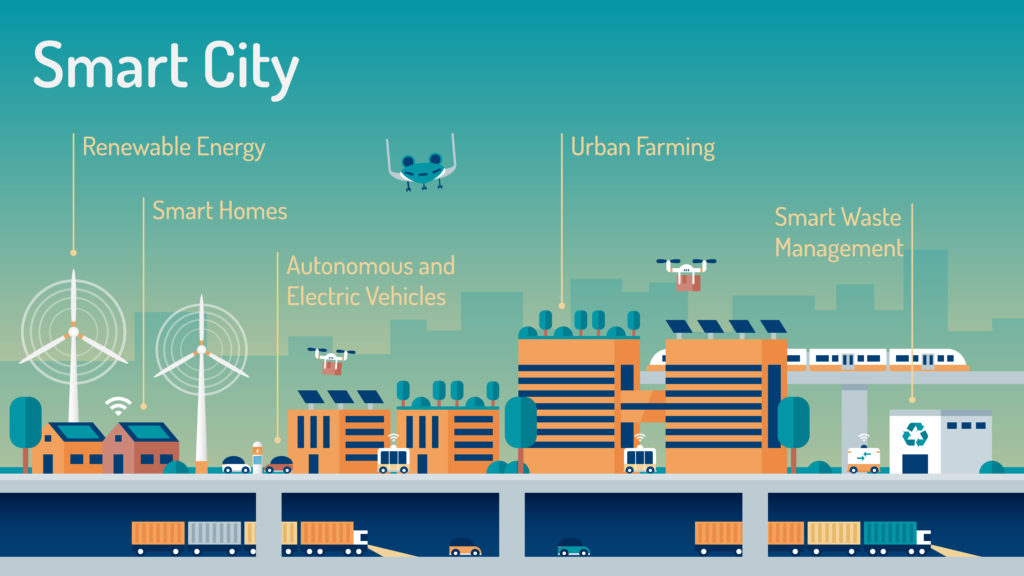

4. Smart and Self-Driving Vehicles

The push for self-driving vehicles and smart car features is intensifying. These vehicles depend on low-latency, high-speed connections to process vast amounts of data in real time, from navigation to safety systems. As testing ramps up, it’s exciting to see what’s to come, especially with connectivity advancements like Vehicle-to-Vehicle (V2V) communication shaping the future of transportation.

5. Increased Electric Power Needs and V2G Solutions

The rise of data centers and electric vehicles (EVs) is driving a need for more electricity. Vehicle-to-grid (V2G) technology, which enables two-way energy flow between EVs and the grid, is becoming a practical solution. These systems require reliable communication networks to manage energy transfer effectively. Meanwhile, the expansion of smart cities and smart grids is paving the way for exciting innovations. I look forward to seeing what’s next as these interconnected systems evolve. Wireless spectrum enables the fast, secure data exchange necessary for V2G systems and other smart technologies to function at scale.

Across all these trends, one thing is clear: wireless spectrum is becoming increasingly critical. Each of these technologies—from AI-driven sensors to smart vehicles and broadband expansion—requires the right spectrum to operate effectively. The challenge lies in matching the best spectrum to the application, ensuring optimal performance and minimal interference.

As demand for connectivity grows, so does the need for careful spectrum management. Organizations must navigate the complexities of spectrum availability to find solutions that meet their specific needs. Whether it’s addressing CBRS congestion, supporting low-latency applications, or enabling rural broadband, selecting the right spectrum is the foundation for success.

2025 promises to be a transformative year for technology, with wireless spectrum at the center of innovation. By understanding these trends and their implications, organizations can position themselves to thrive in a connected, data-driven future.